All about money – Investing, financial literacy and the question of pocket money

We sat down with Stephanie Pow founder of Crayon to chat about all things money and family.

Jessie PetersAugust 24, 2022

We sat down with Stephanie Pow founder of Crayon to chat about all things money and family.

Stephanie is a mother-of-two and the founder of Crayon, a platform that helps parents make smart money moves so they can plan a bright financial future for their family.

Stephanie previously worked in strategic and leadership roles for financial services providers and technology companies. She earned her MBA from Wharton, MPA from Harvard, and Bachelor of Commerce from UNSW.

What are some simple tips you would give parents who want to teach children about money? Where do we start?

Parents are often the first and most influential source of information for tamariki when it comes to money. Upbringing comes up in almost every meaningful conversation I have with people about money .

Kids learn by watching what we as parents do and by listening to the conversation around them so start by talking about money as part of everyday life . 1 in 3 Kiwis rarely or never talk to anyone about their finances, including their friends or family . If you’re not sure where to begin, the Financial Services Council released a set of Money Conversation cards, including a special edition for kids, families and whanau .

How can parents invest well on behalf of their children? Money is so tight for many now, will a little amount still make a difference?

Yes, a small amount will make a difference! Time is one of the biggest influences on how much you make on an investment - the longer, the better. Time is something kids have in spades .

To give you an example, let’s say you invest $10 every month starting when your child is born. By the time they turn 18 years old, you will have set aside $2,160. If we assume an investment return of 7%, this could be worth just over $4,300 when they’re 18 .

For reference, the NZ stock market has returned 10% per year on average over the last 20 years before taxes and fees. Keep in mind that there has been significant variation in the returns year on year, ranging from gains of +30% to losses of -33% .

A former colleague recently shared her approach which resonated with me: kids are expensive (particularly in the first few years) so every time her child-related expenses went down (e.g., when her child turned three and the 20 ECE hours kicked in), she funnelled those savings into an investment account for her child. I like this approach because she used her existing budget, rather than trying to come up with new funds.

Keep an eye on our website because we’ll be publishing an article soon where she shares her investing journey in more detail .

We have a step-by-step guide on picking the right investment approach for your family here

Do you plan to give your children pocket money?

My kids are aged 3 and 1, so not quite old enough for pocket money yet. I plan on giving it to them around age 5. Like every topic when it comes to parenthood there’s quite a bit of debate out there about the “right” way to do this (or even to do it at all).

Here’s the approach I’m going to take and why:

I’m going to start by giving $1 for every year of age. When they’re young, they are just starting to learn the foundational principles of managing money so they don’t need much of it yet. As they get older, their allowance will grow as they take on more responsibility for managing their expenses.

This will be earned for completing a set of 3 age-appropriate chores above and beyond what I expect them to do around the house.

I want them to earn their money and understand the value of work

- Make it physical - use a clear glass jar so they can see their progress

- Teach them how to allocate between four jars: spend, save, grow (investing or something entrepreneurial when they get older) and give

I’m sure I’ll learn as I go - and potentially adjust based on the temperament of each child

Simple tips for families feeling the pinch right now and wanting to weigh up the cost of daycare vs working.

Every family is different so this is tricky to give universal tips on. Here’s my two cents worth: if being in paid work is something you want to do in the medium term, then I suggest looking at the bigger picture of your career trajectory. Although your current paycheck may barely cover childcare costs, there are longer-term benefits to staying in the workforce, such as keeping up to date on industry knowledge and skills and being eligible for promotions and pay rises.

Even though you learn a whole new skill set as a full-time parent (which is a job - just not one you get paid for!), it’s sadly not one that tends to be valued by employers and it can be tough to re-enter the workforce after an extended period of time at home (one international study found that stay-at-home mothers were half as likely to get a job interview as mothers who were laid off)

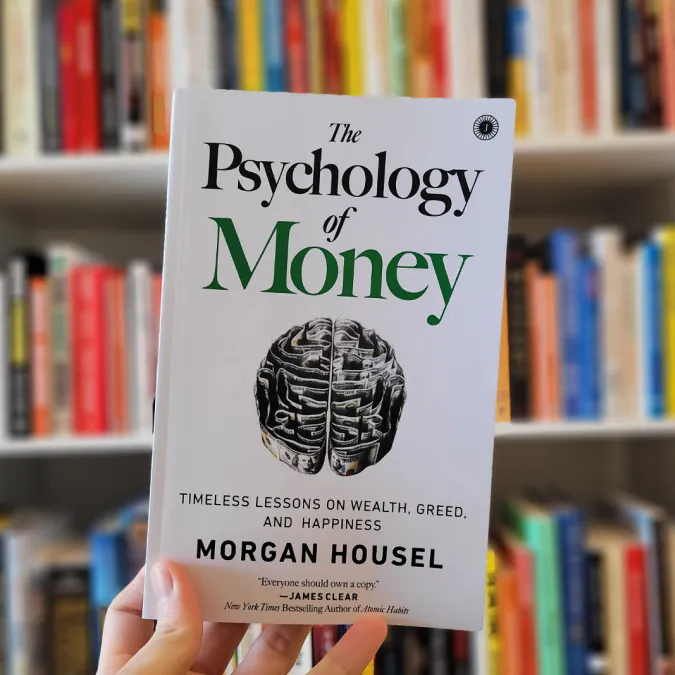

What one book would you recommend for parents who want to learn better money management themselves so they can help teach their tamariki?

The Psychology of Money: Timeless lessons on wealth, greed, and happiness by Morgan Housel. So much of what our tamariki learn about money comes from how we as parents think about money. Morgan Housel has a great way of developing a healthy money mindset that’s aligned with your values and what you want out of life.

Do you have a money lesson you learned the hard way?

Like everyone, I’m a work-in-progress when it comes to money. When I reflect on my spending in my 20s, I can see how much of it could have been more wisely used. To borrow from Marie Kondo, how much joy does a $1 spent in a certain way bring? For example, I consider money spent on takeout because I was too disorganised to cook a meal ‘low joy’ whereas money spent on a date night with my husband is ‘high joy’ even though the date night might be more expensive.

How you and I define joy will be different depending on what we each value. For me, it’s not about benchmarking my spending against others, but rather my spending against my values.

Next Steps

You can find out more information about Go Crayon by visting their website here